Contact Lenses Market Size, Share, Industry Report, 2020

Published: Oct, 2015 | Pages:

136 | Publisher: Radiant Insights Inc.

Industry: Personal Care | Report Format: Electronic (PDF)

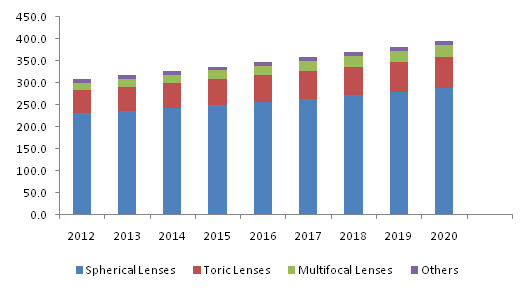

The Report Contains Contact Lenses Market Size By Product (RPG, Soft, Hybrid), By Design (Spherical, Toric, Multifocal), By Usage (Corrective, Therapeutic, Prosthetic, Lifestyle-oriented) Competitive Analysis & Forecast, 2012 - 2020 Industry Overview Global contact lenses market size is expected to reach USD 12,476.3 million by 2020, growing at a CAGR of 6.7% from 2014 to 2020. Increasing number of ophthalmic disorders especially in children is expected to drive demand growth over the next six years. Children with visual deficiencies are driving for expansion of the wearer base. In addition, ageing population suffering from presbyopes is also accountable for the increase in the usage of contact lenses globally. Global increase in demand for plano or non-Rx sunglasses is expected to fuel contact lenses market growth over the forecast period. According to the American Optometric Association (AOA), prolonged exposure to solar radiation increases the risk of macular degeneration. Plano or non-RX sunglasses are used to avoid adverse effects of solar radiation and protect the eyes from UV rays which eventually boost the overall demand. Moreover, rising awareness among the general population regarding the importance of protecting the eyes is also expected to boost plano sunglasses penetration on a global scale. Plano sunglasses shipments were 296.5 million units in 2013, and are expected to reach 394.7 million units by 2020, growing at a CAGR of 4.2% from 2014 to 2020. Increasing demand in outdoor activities is expected to drive growth over the next six years. Outdoor activities include sports, in which spectacles prove to be a cumbersome option, which has amplified the adoption of contact lenses globally. Benefits provided by contact lenses in outdoor activities include unobstructed field of view, enhanced peripheral vision, less likelihood of injury, high clarity regardless of environmental conditions and higher compatibility with safety equipment among others. In addition to the above advantages, the use of daily disposable lenses for outdoor activities effectively eliminates need for using lens care solutions and storage. Growing acceptance of refractive surgeries is posing a challenge to the growth of the contact lenses market. Refractive surgery such as LASIK (Laser-Assisted in Situ Keratomileusis) diminishes the dependency on contact lenses. According to the American Academy of Ophthalmology (AAO), more than 700,000 LASIK procedures were performed in the U.S. in 2009, which has increased to approximately 800,000 in 2011. However, with the increasing fashion trends of colored lenses and unsuccessful surgeries, the impact of refractive surgeries is expected to reduce in the forecast period.North America contact lenses market, by Design, 2012-2020 (Million units)Design Overview Spherical design was the leading design segment and was valued over USD 6,200 million in 2014. North America dominated the regional market in terms of volume, with over a demand of 240 million units in 2014, growing at a CAGR of 2.9% from 2014 to 2020. Multifocal design was the fastest growing design segment and accounted for over 5% of the market in 2014 growing at an estimated CAGR of over 6 % from 2014 to 2020. The demand for multifocal lenses is expected to increase due to its ability of incorporating multiple prescriptions in one lens. In addition, multifocal design lenses are chiefly useful for age-related ophthalmic disorders such as presbyopia. Product Overview Soft contact lenses were the leading product segment and were valued over USD 7,500 million in 2014. These are made up of flexible, soft plastics such as silicone hydrogel, which provide easy flexibility to the eye. It also enhances the comfort of consumers. In addition, it allows additional oxygen to pass through to the wearer’s cornea and is used extensively for ametropia correction. Soft lenses are further segmented into daily disposable, weekly, monthly, annual, extended wear and unplanned replacement schedule. RGP lenses was the second largest product segment and accounted for over 8% of the overall revenue in 2014 growing at an estimated CAGR of over 4.8% from 2014 to 2020. Less expensive and have higher durability are the factors responsible for the significant growth of RGP lenses globally. In addition, it also offers cleaner vision and is mainly used to correct astigmatism and related corneal defects. Usage Overview Corrective lenses are the highest revenue generators as well as the fastest growing usage segment. Corrective lenses were valued over USD 3,600 million in 2014, growing at a CAGR of over 7% from 2014 to 2020. It is available in various lens types including single vision, bifocal, trifocal, progressive, and adjustable focus. The demand for corrective lenses is increasing owing to rising number of ophthalmic disorders globally. Therapeutic Lenses is the second largest usage segment and was valued over USD 2,900 million in 2014, growing at a CAGR of 6% from 2014 to 2020. In 2014, the market share of cosmetic and prosthetic was over 10% and 6% respectively. Regional Overview North America contact lenses market dominated demand with valuation of over USD 3,100 million in 2014. This region is expected to witness higher growth rates owing to high awareness regarding eye examinations. In addition, presence of key industry participants such as CIBA Vision (Alcon), Johnson & Johnson, CooperVision and Bausch + Lomb in this region has increased demand for high-end premium priced products and also resulted in high brand awareness. Europe was the second largest regional industry and accounted for over 30% of the total demand in 2014. Asia Pacific contact lenses market is expected to be the fastest growing regional industry, at an estimated CAGR of over 3% from 2014 to 2020. This is primarily due to increasing instances of myopia among the adults. Moreover, awareness regarding the importance of protecting the eyes against harmful UV radiation is also driving demand in the region. Competitive Market Share The global contact lenses market share is highly consolidated, with the top four companies accounting for over 90% of the total demand in 2013. Johnson & Johnson emerged as the leading company in the global market and accounted for over 40% of the total consumption in 2013 while CIBA accounted for over 24%. CooperVision and Bausch + Lomb accounted for approximately 16% and 14% of the overall share in 2013. Rest of the companies such as Abbott Medical Optics, Inc., Alcon Laboratories, Inc., Carl Zeiss AG, Eagle Optics Pvt. Limited and Essilor International S.A among others accounted for approximately over 10% of the industry share in 2013.

Table of Contents Chapter 1 Executive Summary 1.1 Contact Lenses – Industry Summary & Critical Success Factors (CSFs) Chapter 2 Contact Lenses Industry Overview 2.1 Market Segmentation 2.2 Market Size and Growth Prospects 2.3 Contact Lenses Value Chain Analysis 2.4 Contact Lenses Market Dynamics 2.5 Key Opportunities Prioritized 2.6 Industry Analysis - Porter's 2.7 Contact Lenses - Company Market Share Analysis 2.8 Contact Lenses - PESTEL Analysis 2.9 Contact Lenses – Distribution Channel Analysis Chapter 3 Contact Lenses Product Overview 3.1 Rigid Gas Permeable (RGP) Contact Lenses 3.2 Soft Contact Lenses 3.2.1 Soft Contact Lenses Modality Outlook 3.2.1.1 Daily Disposable 3.2.1.2 Weekly (and two weeks) 3.2.1.3 Monthly 3.2.1.4 Annual 3.2.1.5 Extended Wear 3.2.1.6 Unplanned Replacement Schedule 3.3 Hybrid Contact Lenses Chapter 4 Contact Lenses Design Overview 4.1 Spherical 4.2 Toric 4.3 Multifocal 4.4 Others Chapter 5 Contact Lenses Usage Overview 5.1 Corrective Lenses 5.2 Therapeutic Lenses 5.3 Cosmetic Lenses 5.4 Prosthetic Lenses 5.5 Lifestyle-oriented Lenses Chapter 6 Contact Lenses Regional Overview 6.1 North America 6.2 Europe 6.3 Asia Pacific 6.4 RoW Chapter 7 Competitive Landscape 7.1 Revenue Analysis 7.2 Product Benchmarking 7.3 Strategic Developments Chapter 8 Methodology & Scope 8.1 Research Methodology 8.2 Research Scope & Assumptions 8.3 List of Data Sources Companies analyzed in Chapter 7 1) Abbott Medical Optics, Inc. 2) Alcon Laboratories, Inc. 3) Bausch & Lomb 4) Carl Zeiss AG 5) CIBA Vision 6) Contamac U.S. 7) CooperVision 8) Eagle Optics Pvt. Limited 9) Essilor International 10) Hoya Corporation 11) Hydrogel Vision Corp 12) Johnson & Johnson 13) Medennium Inc. 14) STAAR Surgical Company 15) SynergEyes, Inc.

List of Tables 1. Contact Lenses – Industry Summary & Critical Success Factors (CSFs) 2. Global Contact Lenses Market (Volume & Revenue), 2012 - 2020 3. Global Contact Lenses Market Volume by Region (Million Units), 2012 – 2020 4. Global Contact Lenses Market Revenue by Region (USD Million), 2012 – 2020 5. Global Contact Lenses Market Volume by Product (Million Units), 2012 – 2020 6. Global Contact Lenses Market Revenue by Product (USD Million), 2012 – 2020 7. Global Contact Lenses Market Volume by Design (Million Units), 2012 – 2020 8. Global Contact Lenses Market Revenue by Design (USD Million), 2012 – 2020 9. Global Contact Lenses Market Volume by Usage (Million Units), 2012 – 2020 10. Global Contact Lenses Market Revenue by Usage (USD Million), 2012 – 2020 11. Global RGP contact lenses demand (Volume & Revenue), 2012 - 2020 12. Global RGP contact lenses demand by region (Volume), 2012 – 2020 13. Global RGP contact lenses demand by region (Revenue), 2012 – 2020 14. Global soft contact lenses demand (Volume & Revenue), 2012 - 2020 15. Global soft contact lenses demand by region (Volume), 2012 – 2020 16. Global soft contact lenses demand by region (Revenue), 2012 – 2020 17. Global daily disposable contact lenses demand (Volume & Revenue), 2012 - 2020 18. Global daily disposable contact lenses demand by region (Volume), 2012 – 2020 19. Global daily disposable contact lenses demand by region (Revenue), 2012 – 2020 20. Global weekly contact lenses demand (Volume & Revenue), 2012 - 2020 21. Global weekly contact lenses demand by region (Volume), 2012 – 2020 22. Global weekly contact lenses demand by region (Revenue), 2012 – 2020 23. Global monthly contact lenses demand (Volume & Revenue), 2012 - 2020 24. Global monthly contact lenses demand by region (Volume), 2012 – 2020 25. Global monthly contact lenses demand by region (Revenue), 2012 – 2020 26. Global annual contact lenses demand (Volume & Revenue), 2012 - 2020 27. Global annual contact lenses demand by region (Volume), 2012 – 2020 28. Global annual contact lenses demand by region (Revenue), 2012 – 2020 29. Global extended wear contact lenses demand (Volume & Revenue), 2012 - 2020 30. Global extended wear contact lenses demand by region (Volume), 2012 – 2020 31. Global extended wear contact lenses demand by region (Revenue), 2012 – 2020 32. Global unplanned replacement contact lenses demand (Volume & Revenue), 2012 - 2020 33. Global unplanned replacement contact lenses demand by region (Volume), 2012 – 2020 34. Global unplanned replacement contact lenses demand by region (Revenue), 2012 – 2020 35. Global hybrid contact lenses demand (Volume & Revenue), 2012 - 2020 36. Global hybrid contact lenses demand by region (Volume), 2012 – 2020 37. Global hybrid contact lenses demand by region (Revenue), 2012 – 2020 38. Global spherical contact lenses demand (Volume & Revenue), 2012 - 2020 39. Global spherical contact lenses demand by region (Volume), 2012 – 2020 40. Global spherical contact lenses demand by region (Revenue), 2012 – 2020 41. Global toric contact lenses demand (Volume & Revenue), 2012 - 2020 42. Global toric contact lenses demand by region (Volume), 2012 – 2020 43. Global toric contact lenses demand by region (Revenue), 2012 – 2020 44. Global multifocal contact lenses demand (Volume & Revenue), 2012 - 2020 45. Global multifocal contact lenses demand by region (Volume), 2012 – 2020 46. Global multifocal contact lenses demand by region (Revenue), 2012 – 2020 47. Global other contact lenses demand (Volume & Revenue), 2012 - 2020 48. Global other contact lenses demand by region (Volume), 2012 – 2020 49. Global other contact lenses demand by region (Revenue), 2012 – 2020 50. Global corrective contact lenses demand (Volume & Revenue), 2012 - 2020 51. Global corrective contact lenses demand by region (Volume), 2012 – 2020 52. Global corrective contact lenses demand by region (Revenue), 2012 – 2020 53. Global therapeutic contact lenses demand (Volume & Revenue), 2012 - 2020 54. Global therapeutic contact lenses demand by region (Volume), 2012 – 2020 55. Global therapeutic contact lenses demand by region (Revenue), 2012 – 2020 56. Global cosmetic contact lenses demand (Volume & Revenue), 2012 - 2020 57. Global cosmetic contact lenses demand by region (Volume), 2012 – 2020 58. Global cosmetic contact lenses demand by region (Revenue), 2012 – 2020 59. Global prosthetic contact lenses demand (Volume & Revenue), 2012 - 2020 60. Global prosthetic contact lenses demand by region (Volume), 2012 – 2020 61. Global prosthetic contact lenses demand by region (Revenue), 2012 – 2020 62. Global lifestyle-oriented contact lenses demand (Volume & Revenue), 2012 - 2020 63. Global lifestyle-oriented contact lenses demand by region (Volume), 2012 – 2020 64. Global lifestyle-oriented contact lenses demand by region (Revenue), 2012 – 2020 65. Global spectacles frames demand by region (Volume), 2012 – 2020 66. North America contact lenses market by product (Volume), 2012 – 2020 67. North America contact lenses market by product (Revenue), 2012 – 2020 68. North America contact lenses market by design (Volume), 2012 – 2020 69. North America contact lenses market by design (Revenue), 2012 – 2020 70. North America contact lenses market by usage (Volume), 2012 – 2020 71. North America contact lenses market by usage (Revenue), 2012 – 2020 72. Europe contact lenses market by product (Volume), 2012 – 2020 73. Europe contact lenses market by product (Revenue), 2012 – 2020 74. Europe contact lenses market by design (Volume), 2012 – 2020 75. Europe contact lenses market by design (Revenue), 2012 – 2020 76. Europe contact lenses market by usage (Volume), 2012 – 2020 77. Europe contact lenses market by usage (Revenue), 2012 – 2020 78. Asia Pacific contact lenses market by product (Volume), 2012 – 2020 79. Asia Pacific contact lenses market by product (Revenue), 2012 – 2020 80. Asia Pacific contact lenses market by design (Volume), 2012 – 2020 81. Asia Pacific contact lenses market by design (Revenue), 2012 – 2020 82. Asia Pacific contact lenses market by usage (Volume), 2012 – 2020 83. Asia Pacific contact lenses market by usage (Revenue), 2012 – 2020 84. RoW contact lenses market by product (Volume), 2012 – 2020 85. RoW contact lenses market by product (Revenue), 2012 – 2020 86. RoW contact lenses market by design (Volume), 2012 – 2020 87. RoW contact lenses market by design (Revenue), 2012 – 2020 88. RoW contact lenses market by usage (Volume), 2012 – 2020 89. RoW contact lenses market by usage (Revenue), 2012 – 2020 List of Figures 1. Contact Lenses Market Segmentation 2. Global Contact Lenses Market (Volume & Revenue), 2012 - 2020 3. Contact Lenses Value Chain Analysis 4. Contact Lenses Market Dynamics 5. Contact Lenses Company Market Share Analysis, 2012 6. Key Opportunities Prioritized 7. Industry Analysis - Porter's 8. Contact Lenses PESTEL Analysis, 2012 9. Contact Lenses Distribution Channel Analysis 10. Contact Lenses market share by product, 2012 & 2020 11. Global RGP contact lenses market demand (Volume & Revenue), 2012 – 2020 12. Global soft contact lenses market demand (Volume & Revenue), 2012 – 2020 13. Global hybrid contact lenses market demand (Volume & Revenue), 2012 – 2020 14. Contact Lenses market share by design, 2012 & 2020 15. Global spherical contact lenses market demand (Volume & Revenue), 2012 – 2020 16. Global toric contact lenses market demand (Volume & Revenue), 2012 – 2020 17. Global multifocal contact lenses market demand (Volume & Revenue), 2012 – 2020 18. Global other contact lenses market demand (Volume & Revenue), 2012 – 2020 19. Contact Lenses market share by usage, 2012 & 2020 20. Global corrective contact lenses market demand (Volume & Revenue), 2012 – 2020 21. Global therapeutic contact lenses market demand (Volume & Revenue), 2012 – 2020 22. Global cosmetic contact lenses market demand (Volume & Revenue), 2012 – 2020 23. Global prosthetic contact lenses market demand (Volume & Revenue), 2012 – 2020 24. Global lifestyle-oriented contact lenses market demand (Volume & Revenue), 2012 – 2020 25. Contact Lenses market share by region, 2012 & 2020 26. North America contact lenses market volume, by product, 2012 – 2020 27. North America contact lenses market revenue, by product, 2012 – 2020 28. North America contact lenses market volume, by design, 2012 – 2020 29. North America contact lenses market revenue, by design, 2012 - 2020 30. North America contact lenses market volume, by usage, 2012 – 2020 31. North America contact lenses market revenue, by usage, 2012 – 2020 32. Europe contact lenses market volume, by product, 2012 – 2020 33. Europe contact lenses market revenue, by product, 2012 – 2020 34. Europe contact lenses market volume, by design, 2012 – 2020 35. Europe contact lenses market revenue, by design, 2012 - 2020 36. Europe contact lenses market volume, by usage, 2012 – 2020 37. Europe contact lenses market revenue, by usage, 2012 - 2020 38. Asia Pacific contact lenses market volume, by product, 2012 – 2020 39. Asia Pacific contact lenses market revenue, by product, 2012 – 2020 40. Asia Pacific contact lenses market volume, by design, 2012 – 2020 41. Asia Pacific contact lenses market revenue, by design, 2012 - 2020 42. Asia Pacific contact lenses market volume, by usage, 2012 – 2020 43. Asia Pacific contact lenses market revenue, by usage, 2012 - 2020 44. RoW contact lenses market volume, by product, 2012 – 2020 45. RoW contact lenses market revenue, by product, 2012 – 2020 46. RoW contact lenses market volume, by design, 2012 – 2020 47. RoW contact lenses market revenue, by design, 2012 - 2020 48. RoW contact lenses market volume, by usage, 2012 – 2020 49. RoW contact lenses market revenue, by usage, 2012 - 2020

To request a free sample copy of this report, please complete the form below.

Interested in this report? Get your FREE sample now! Get a Free Sample

Choose License Type

Did you know?

Research Assistance

Why to buy from us

Custom research service

Speak to the report author to design an exclusive study to serve your research needs.

Information security

Your personal and confidential information is safe and secure.