Automotive Electronics Market Size, Share, Report 2020

Published: Oct, 2015 | Pages:

98 | Publisher: Radiant Insights Inc.

Industry: Parts And Suppliers | Report Format: Electronic (PDF)

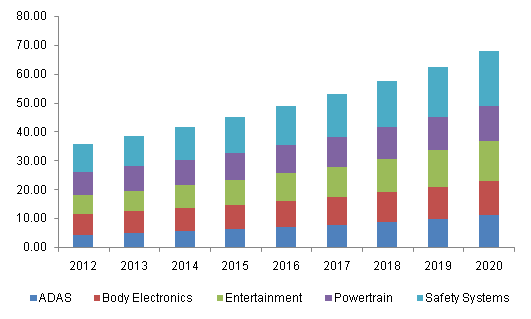

The Reports Contains Automotive Electronics Market Size By Application (Body Electronics, Infotainment, Advanced Driver Assistance System (ADAS), Powertrain, Safety Systems), Competitive Analysis & Forecasts To 2020 Industry Overview Global automotive electronics market size is expected to exceed USD 275 billion by 2020, growing at a CAGR of over 8% from 2014 to 2020. Proliferating application of this equipment across various industry segments is anticipated to drive the industry growth. Exponential growth in installation base of sophisticated safety features such as alcohol ignition interlocks, accident data recorder system and emergency call system are likely to fuel the industry demand. Driver assistance systems and low-speed collision avoidance systems are prominent technologies, with numerous application options are offered by installation of map-enabled systems in automotives. This facilitates in lane departure systems, driver assistance systems, and intelligent front lighting systems enabled by united adaptive front lighting. Key safety technologies include collision warning, usage data transmission, speed alert, and map-supported adaptive front lighting. Occupant protection technology is estimated to witness significant growth over the forecast period. Ascending demand for development of direct-injection diesel engines is expected to boost automotive electronics industry growth. It offers 15% better fuel economy over swirl-chamber and pre-chamber. It aids in lowering emissions and offers a cooling system for heavy duty vehicles. LED technologies such as daylight running lamps (DRL) as well as high/low beam lights offer low power consumption and better fuel efficiency. These technologies are likely to witness significant growth owing to advancements in industry coupled by drop in LED prices. Increasing number of ECUs is projected to increase the complexity of subsystems. Complexities such as tolerance stack-up, harsh operating environment and hardware/software complexity are likely to hider automotive electronics market demand. However, lack of awareness about interplay of subsystem along with coordination issues among OEMs and embedded controller manufacturers may pose a challenge to the industry growth. Regulatory board in various countries are now taking initiatives to ensure passenger safety owing to increasing number of fatalities. Incorporation of safety devices namely airbags, back up sensing system, electro chromatic mirror/auto dimming mirrors and heads-up display offer potential avenues for industry participants.North America automotive electronics market size, by application, 2012-2020 (USD Billion)Application Overview Safety systems were the leading application segment. It accounted for more than 28% of the global automotive electronics market in 2013. It is estimated to exceed USD 19 billion by 2020 growing at a CAGR of over 8% from 2014 to 2020. The surge can be attributed to increasing safety initiatives from government as well as regulatory agencies. ADAS is anticipated to be the fastest growing segment. It was valued over USD 4.50 billion in 2013 and it is expected to grow at a CAGR of over 12% from 2014 to 2020. The growth in the industry can be credited to adoption of active safety systems in low-cost cars along with government norms on mandating ADAS deployment. Regional Overview Asia Pacific automotive electronics market was valued over USD 65 billion in 2013 and it is likely to exceed USD 120 billion by 2020. The region is anticipated to exhibit highest growth rates owing to increasing need for customized vehicle, low production cost and superior product quality. North America accounted for more than 20% of the overall industry and is forecast to exceed USD 65 billion by 2020 growing at over 8% from 2014 to 2020. The growth can be attributed to increasing consumer demands for comfort and convenience along with focus on safety. Competitive Market Share The global automotive electronics market share is highly consolidated by top two industry players accounting for more than 40% of the overall industry share in 2013. Continental AG focuses on under-the-hood electronics, powertrain, body and chassis related ECUs Bosch holds comparable market share in comparison to Continental AG. Key industry participants include Denso, Delphi, ZF Friedrichshafen and TRW among others.

Table of Contents Chapter 1 Methodology and Scope 1.1 Research Methodology 1.2 Research Scope & Assumptions 1.3 List of Data Sources Chapter 2 Executive Summary 2.1 Automotive electronics - Industry summary & Critical Success Factors (CSFs) Chapter 3 Automotive Electronics Industry Overview 3.1 Market segmentation 3.2 Market size and growth prospects 3.3 Automotive electronics value chain analysis 3.4 Automotive electronics market dynamics 3.4.1 Market driver analysis 3.4.1.1 Technological shift towards advanced safety features 3.4.1.2 Fuel efficiency and reduced emissions 3.4.2 Market restraint analysis 3.4.2.1 High level of complexity 3.5 Key opportunities - Prioritized 3.6 Industry Analysis - Porter’s 3.7 Automotive electronics - Company market share analysis, 2013 3.8 Automotive electronics PESTEL analysis Chapter 4 Automotive Electronics Application Overview 4.1 Automotive electronics market share by application, 2013 & 2020 4.2 ADAS 4.3 Body Electronics 4.4 Entertainment 4.5 Powertrain 4.6 Safety Systems Chapter 5 Automotive Electronics Market Regional Overview 5.1 Automotive electronics market share by region, 2013 & 2020 5.2 North America 5.2.1 North America automotive electronics market by application, 2012 – 2020 5.2.2 U.S. 5.2.2.1 U.S. automotive electronics market by application, 2012 – 2020 5.3 Europe 5.3.1 Europe automotive electronics market by application, 2012 – 2020 5.3.2 Germany 5.3.2.1 Germany automotive electronics market by application, 2012 – 2020 5.3.3 UK 5.3.3.1 UK automotive electronics market by application, 2012 – 2020 5.4 Asia Pacific 5.4.1 Asia Pacific automotive electronics market by application, 2012 – 2020 5.4.2 China 5.4.2.1 China automotive electronics market by application, 2012 – 2020 5.4.3 India 5.4.3.1 India automotive electronics market by application, 2012 – 2020 5.4.4 Japan 5.4.4.1 Japan automotive electronics market by application, 2012 – 2020 5.5 RoW 5.5.1 RoW automotive electronics market by application, 2012 – 2020 5.5.2 Brazil 5.5.2.1 Brazil automotive electronics market by application, 2012 – 2020 Chapter 6 Competitive Landscape 6.1 Altera Corporation 6.1.1 Company Overview 6.1.2 Financial Performance 6.1.3 Product Benchmarking 6.1.4 Strategic Initiatives 6.2 Atmel Corporation 6.2.1 Company Overview 6.2.2 Financial Performance 6.2.3 Product Benchmarking 6.2.4 Strategic Initiatives 6.3 Audiovox Corporation 6.3.1 Company Overview 6.3.2 Financial Performance 6.3.3 Product Benchmarking 6.3.4 Strategic Initiatives 6.4 Avago Technologies 6.4.1 Company Overview 6.4.2 Financial Performance 6.4.3 Product Benchmarking 6.4.4 Strategic Initiatives 6.5 Bosch Group 6.5.1 Company Overview 6.5.2 Financial Performance 6.5.3 Product Benchmarking 6.5.4 Strategic Initiatives 6.6 Continental AG 6.6.1 Company Overview 6.6.2 Financial Performance 6.6.3 Product Benchmarking 6.6.4 Strategic Initiatives 6.7 Delphi Automotive PLC 6.7.1 Company Overview 6.7.2 Financial Performance 6.7.3 Product Benchmarking 6.7.4 Strategic Initiatives 6.8 Denso Corporation 6.8.1 Company Overview 6.8.2 Financial Performance 6.8.3 Product Benchmarking 6.8.4 Strategic Initiatives 6.9 Dow Corning 6.9.1 Company Overview 6.9.2 Financial Performance 6.9.3 Product Benchmarking 6.9.4 Strategic Initiatives 6.10 Hitachi Automotive Systems, Ltd. 6.10.1 Company Overview 6.10.2 Financial Performance 6.10.3 Product Benchmarking 6.10.4 Strategic Initiatives 6.11 Infineon Technologies AG 6.11.1 Company Overview 6.11.2 Financial Performance 6.11.3 Product Benchmarking 6.11.4 Strategic Initiatives 6.12 Panasonic 6.12.1 Company Overview 6.12.2 Financial Performance 6.12.3 Product Benchmarking 6.12.4 Strategic Initiatives 6.13 Texas Instruments 6.13.1 Company Overview 6.13.2 Financial Performance 6.13.3 Product Benchmarking 6.13.4 Strategic Initiatives 6.14 TRW Automotive 6.14.1 Company Overview 6.14.2 Financial Performance 6.14.3 Product Benchmarking 6.14.4 Strategic Initiatives 6.15 Wipro 6.15.1 Company Overview 6.15.2 Financial Performance 6.15.3 Product Benchmarking 6.15.4 Strategic Initiatives

List of Tables TABLE 1 Global automotive electronics market, (USD Billion), 2012 - 2020 TABLE 2 Global automotive electronics market by region, (USD Billion), 2012 - 2020 TABLE 3 Global automotive electronics market by application, (USD Billion), 2012 - 2020 TABLE 4 Global automotive electronics demand in ADAS by region, 2012 – 2020 (USD Billion) TABLE 5 Global automotive electronics demand in body electronics by region, 2012 – 2020 (USD Billion) TABLE 6 Global automotive electronics demand in entertainment by region, 2012 – 2020 (USD Billion) TABLE 7 Global automotive electronics demand in powertrain by region, 2012 – 2020 (USD Billion) TABLE 8 Global automotive electronics demand in safety systems by region, 2012 – 2020 (USD Billion) TABLE 9 North America automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 10 U.S. automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 11 Europe automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 12 Germany automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 13 UK automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 14 Asia Pacific automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 15 China automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 16 India automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 17 Japan automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 18 RoW automotive electronics market by application (USD Billion), 2012 – 2020 TABLE 19 Brazil automotive electronics market by application (USD Billion), 2012 – 2020 List of Figures FIG. 1 Automotive electronics market segmentation FIG. 2 Global automotive electronics market (USD Billion), 2012 - 2020 FIG. 3 Automotive electronics value chain analysis FIG. 4 Automotive electronics market dynamics FIG. 5 Key opportunities prioritized FIG. 6 Automotive electronics - Porter’s analysis FIG. 7 Automotive electronics company market share analysis, 2013 FIG. 8 Automotive electronics PESTEL analysis FIG. 9 Automotive electronics market share by application, 2013 & 2020 FIG. 10 Global automotive electronics demand in ADAS (USD Billion), 2012 - 2020 FIG. 11 Global automotive electronics demand in body electronics (USD Billion), 2012 - 2020 FIG. 12 Global automotive electronics demand in entertainment (USD Billion), 2012 - 2020 FIG. 13 Global automotive electronics demand in powertrain (USD Billion), 2012 - 2020 FIG. 14 Global automotive electronics demand in safety systems (USD Billion), 2012 - 2020 FIG. 15 Automotive electronics market share by region, 2013 & 2020 FIG. 16 North America automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 17 U.S. automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 18 Europe automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 19 Germany automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 20 UK automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 21 Asia Pacific automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 22 China automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 23 India automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 24 Japan automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 25 RoW automotive electronics market by application (USD Billion), 2012 – 2020 FIG. 26 Brazil automotive electronics market by application (USD Billion), 2012 – 2020

To request a free sample copy of this report, please complete the form below.

Interested in this report? Get your FREE sample now! Get a Free Sample

Choose License Type

Did you know?

Research Assistance

Why to buy from us

Custom research service

Speak to the report author to design an exclusive study to serve your research needs.

Information security

Your personal and confidential information is safe and secure.